Offshore Company Formation: Your Path to International Success

Offshore Company Formation: Your Path to International Success

Blog Article

Approaches for Cost-Effective Offshore Firm Formation

When thinking about overseas business development, the mission for cost-effectiveness comes to be a vital issue for organizations seeking to expand their operations worldwide. offshore company formation. By checking out nuanced approaches that blend legal conformity, financial optimization, and technical advancements, services can get started on a path in the direction of overseas firm formation that is both economically sensible and tactically audio.

Choosing the Right Territory

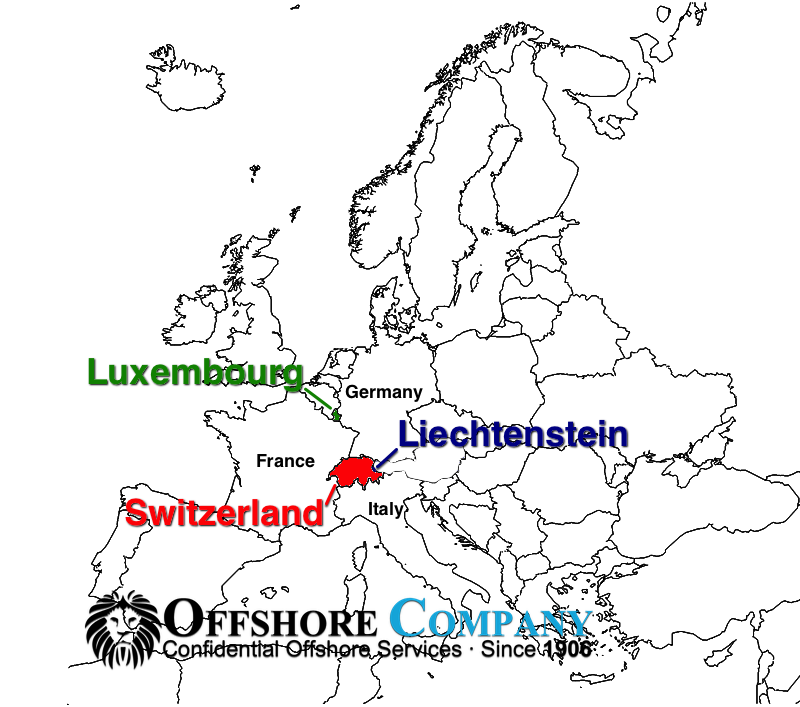

When establishing an overseas firm, picking the appropriate jurisdiction is an important choice that can considerably affect the success and cost-effectiveness of the formation procedure. The territory picked will establish the regulatory framework within which the company operates, affecting taxation, reporting needs, privacy laws, and total service versatility.

When selecting a jurisdiction for your overseas firm, numerous elements have to be taken into consideration to make sure the choice lines up with your tactical goals. One vital aspect is the tax obligation regimen of the territory, as it can have a substantial effect on the business's productivity. Additionally, the degree of regulative conformity needed, the political and economic stability of the jurisdiction, and the simplicity of doing company needs to all be reviewed.

In addition, the track record of the jurisdiction in the international company neighborhood is crucial, as it can influence the perception of your business by customers, partners, and banks - offshore company formation. By very carefully assessing these aspects and looking for specialist recommendations, you can pick the best jurisdiction for your overseas business that enhances cost-effectiveness and sustains your business goals

Structuring Your Company Efficiently

To make certain optimum efficiency in structuring your overseas company, thorough interest must be offered to the business structure. By developing a transparent possession framework, you can make certain smooth decision-making procedures and clear lines of authority within the business.

Next, it is important to think about the tax effects of the selected framework. Various territories use differing tax obligation benefits and motivations for offshore firms. By meticulously assessing the tax obligation legislations and laws of the selected jurisdiction, you can maximize your firm's tax efficiency and lessen unneeded costs.

Additionally, maintaining proper documentation and documents is crucial for the efficient structuring of your offshore business. By maintaining accurate and updated records of monetary transactions, corporate decisions, and compliance documents, you can guarantee transparency and accountability within the company. This not just promotes smooth operations yet likewise aids in showing compliance with regulative needs.

Leveraging Technology for Savings

Effective structuring of your overseas company not just pivots on meticulous focus to organizational structures yet likewise on leveraging innovation for savings. One way to utilize innovation for savings in overseas company development is by using cloud-based solutions for data storage space and cooperation. By incorporating modern technology tactically right into your overseas company development procedure, you can attain significant financial savings while improving operational effectiveness.

Decreasing Tax Obligations

Utilizing tactical tax planning techniques can properly lower the financial worry of tax obligations for offshore firms. In addition, taking advantage of tax obligation incentives and exceptions provided by the jurisdiction where the offshore company is signed up can result in significant cost savings.

One more approach to lessening tax liabilities is by structuring the offshore company in a tax-efficient manner - offshore company formation. This entails thoroughly creating the possession and operational framework to enhance tax advantages. As an this content example, establishing a holding firm in a jurisdiction with positive tax obligation legislations can aid combine earnings and reduce tax obligation direct exposure.

In addition, staying updated on international tax guidelines and conformity demands is vital for lowering tax responsibilities. By guaranteeing strict adherence to tax obligation legislations and regulations, offshore companies can avoid pricey penalties and tax disputes. Seeking professional recommendations from tax consultants or legal professionals concentrated on worldwide tax obligation issues can likewise offer beneficial insights into reliable tax preparation methods.

Making Sure Conformity and Risk Mitigation

Applying durable compliance procedures is important for overseas companies to mitigate risks and keep regulative adherence. Offshore territories typically encounter enhanced examination as a result of issues relating to cash laundering, tax evasion, and various other economic crimes. To guarantee conformity and minimize threats, overseas firms ought to conduct detailed due diligence on customers and service companions to avoid participation in illegal activities. Furthermore, executing Know Your Client (KYC) and Anti-Money Laundering (AML) treatments can assist Source verify the authenticity of purchases and guard the business's credibility. Regular audits and testimonials of financial documents are vital to identify any kind of abnormalities or non-compliance problems quickly.

Furthermore, remaining abreast of altering laws and legal demands is crucial for overseas business to adapt their conformity methods accordingly. Engaging lawful experts or compliance professionals can supply valuable assistance on navigating complex regulatory landscapes and making sure adherence to worldwide standards. By focusing on conformity and danger mitigation, offshore firms can improve transparency, develop depend on with stakeholders, and guard their operations from potential legal repercussions.

Verdict

Making use of strategic tax planning methods can efficiently lower the monetary burden of tax responsibilities for overseas business. By distributing profits to entities in low-tax territories, overseas companies can legitimately reduce their overall tax obligation responsibilities. Additionally, taking advantage of tax obligation rewards and exceptions provided by the territory where the overseas business is registered can result in significant savings.

By making sure rigorous adherence to tax laws and regulations, offshore companies can prevent pricey fines and tax obligation disagreements.In final thought, cost-effective overseas business formation requires cautious consideration of territory, effective structuring, innovation utilization, tax minimization, and compliance.

Report this page